Netheos, a trusted third party, and MiTrust, a FinTech specializing in the simple and responsible sharing of personal data, are joining forces in a strategic partnership.

Uploading credentials is a necessary evil for online applications

Necessary for the constitution of files in many sectors (banking, insurance, real estate, etc.), the supporting documents induce a rupture in the customer experience. The number of documents to collect, scan and transmit is a real obstacle for the user. The high abandonment rate at this stage of the user journey is a direct consequence of this reality.

At the same time, for companies, this regulatory constraint leads to a sharp increase in compliance expenses, notably through a massive increase in staff (control, risk and compliance functions, but also in customer service).

Netheos develops technologies to help users in this tedious step. They analyze the downloaded documents in real time, and provide automatic feedback to the user if necessary. They also allow to protect against document fraud thanks to a thorough authenticity control.

A solution that secures the sharing of personal data

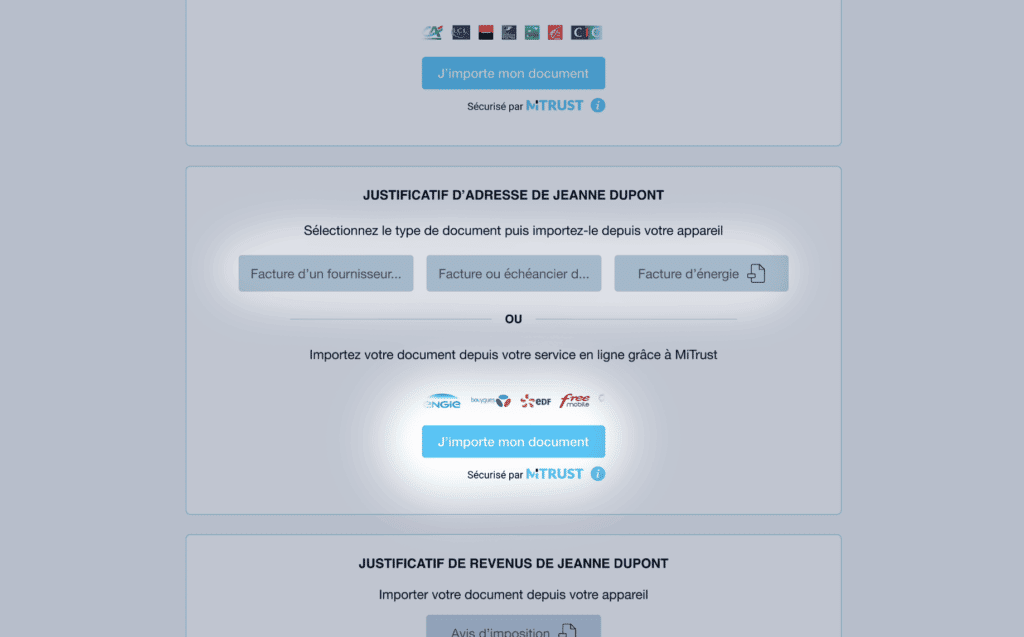

As an alternative to uploading receipts, Netheos now offers MiTrust’s aggregation solution, which allows users to share their data and receipts directly from their service providers (large billers, telephone operators, tax authorities, etc.) to the Netheos client who requests them. All 100% online, under strict user control and without downloading.

Registered with the ACPR Banque de France as an Account Information Service Provider, already present in 3 European countries and with clients in 5 industries, MiTrust offers Netheos its technology and experience in two main use cases:

- Compliance and anti-fraud use.

- Automatic form filling thanks to the recovery of extended data (not necessarily appearing on the receipt)

The overall objective of the integration of this technology is to simplify, secure and accelerate the recovery of customer credentials (home, income, bank), while capitalizing on the new user rights related to the GDPR (more specifically, the Right to Data Portability and the principle of Data Minimization).

The benefits are multiple

For the user, the time to retrieve the documents is drastically reduced: no need to scan, photograph, transfer or download the document. The user connects via MiTrust to one of his MiTrust-connected service providers, selects and validates the sharing of his data and documents instantly. Subscription is simplified and the abandonment rate is reduced: just as it is now anachronistic to pay for a purchase online with cash or check, it will soon be anachronistic to use a document download to transfer qualified data.

The company requesting the credentials is guaranteed to receive 100% authentic and reliable documents since they cannot be altered by the user. For companies, this solution is a real bulwark against document fraud. The costs of processing the files are therefore reduced to a minimum since they do not need to be verified by an operator. The regulatory obligations are thus perfectly respected.

“We were looking for a partner that could help our users simply share their personal data while ensuring their security. MiTrust allowed us to implement the most seamless and secure subscription path for both the end user and our customer.”

A shared vision of responsibility

At both Netheos and MiTrust, our ambition is to develop data sharing solutions that balance security and customer experience with accountability.

This is confirmed by Xavier Drilhon, co-founder and president of MiTrust:

“Without trust, no transaction is possible, and this is even more true in the digital world! MiTrust’s mission is to make digital relationships more harmonious by reconciling security and simplicity through the online sharing of trusted personal data. Thanks to Netheos, we can immediately offer this vision of responsible personal data sharing to a large number of players, especially in the financial sector.”