On January 13, 2018, Directive 2015/2366 on payment services in the European internal market (known as ” PSD2 “) came into force.

This text aims to :

- Adapt existing regulations to the new electronic payment services by defining common rules in terms of security;

- Encourage the emergence of new players and innovative solutions by creating an ecosystem that communicates via APIs.

In France, the directive has been transposed into national law via order no. 2017-1252 of August 9, 2017 creating two new payment services (the account information service and the payment initiation service) and a new category of payment service providers (account information service providers).

Evolving uses drive banking transformation

The relationship between customers and banks has changed over the past 15 years. The agency, which used to be the main meeting point, has been abandoned in favor of the various players’ mobile applications. The figures for multi-banking and banking mobility increase every year.

Customers demand greater responsiveness, availability and service from their bank(s).

The ” fintechs ” have seized on these issues and are shaking up the traditional players by offering ever more innovative services. Lulled by agile methods and continuous deployment cycles, these startups move forward at a frenetic, hyper-challenging pace.

Banks must become API companies

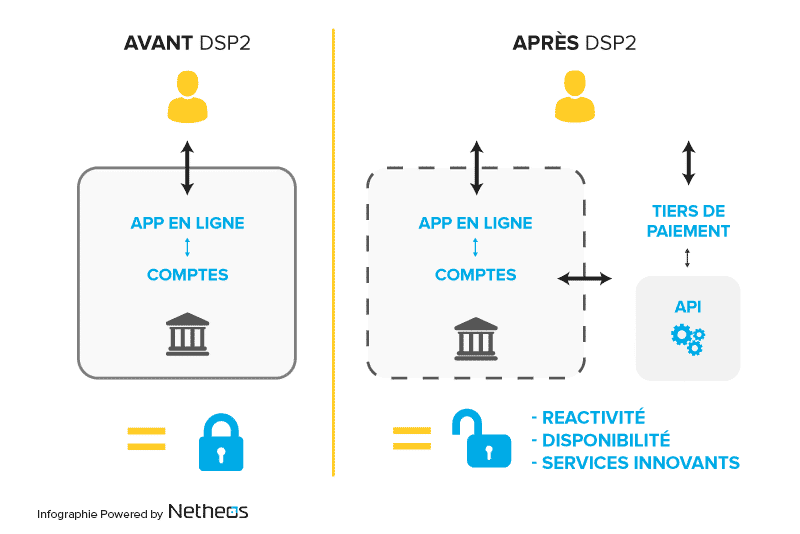

To offer innovative financial services, fintechs need access to their customers’ banking data. In the absence of a standardized information exchange system, fintechs have resorted to the so-called “screen scraping” technique, which involves asking customers to identify themselves on their bank’s website and then extracting the information directly from the banking portal web page.

The banks are opposed to this technique, which, although functional, poses security problems. What’s more, banks aren’t too happy about having to share their “treasure trove” of data with more or less direct competitors.

PSD2 clarifies the situation by obliging banks to give payment service providers access to payment accounts. Through Regulatory Technical Standards (RTS), the European Commission requires banks to set up an API (Application Programming Interface) to enable various payment services to access their customers’ data.

Banks must therefore modernize their infrastructures, application platforms and processes at breakneck speed, and learn a new trade in order to be able to dialogue with fintechs born in the age of APIs.

What’s more, banks have to make these changes without impacting their millions of customers, while fintechs still only have a few thousand.

Payment is not the only business to innovate

PSD2 is both the consequence and the cause of the innovation that is shaking up the world of finance. By providing a clear legal and technical framework, the text has removed the last remaining obstacles, and investment in fintechs more than doubled in 2017 compared with 2016 in Europe.

Innovation affects every aspect of the banking offering. Payment is obviously at the heart of the revolution, with fintechs like Sharepay, for example, offering a payment card for sharing expenses between several accounts. Account management is also evolving, with the integration of artificial intelligence to predict future spending and, for example, encourage customers to increase their savings in anticipation of their summer vacations. Wells Fargo, in the United States, has just integrated this functionality into its mobile application.

Banking KYC (“Know Your Customer”), the compulsory customer identification process when entering into a relationship or granting a loan, for example, has not been forgotten by fintechs. Thanks to the DSP2, it is now possible to easily access a customer’s history (with his or her consent, of course) and thus consolidate a body of evidence to ensure the identity of the customer and the actual existence of the declared account. This type of procedure streamlines the identification process, notably by requiring fewer supporting documents.

DSP2: What’s next?

Banks aren’t just opening up their databases to fintechs. They, too, are launching innovations (in-house or in collaboration with fintechs) across the board, whether on the subject of authentication, like Société Générale with the use of selfies and video interviews to open a bank account. Or in customer relations, with LCL’s recent launch of a Messenger chatbot. What’s more, PSD2 opens up a new business model for them, that of data providers. They will be able to monetize the wealth of data they possess and regain control over it.

While it’s still too early to draw conclusions from PSD2, it’s clear that we’re only at the beginning of a series of major innovations in the financial sector.