Definition of identity verification

What is identity verification?

Identity verification is the process of validating and confirming the authenticity of an identity provided by an individual. Its purpose is to ensure that the personal information provided corresponds to the person’s real identity. This process can be carried out in a variety of contexts, such as access to online services, financial transactions, international travel and legal identification procedures.

Identity verification is crucial to ensuring security, confidentiality and trust in online and offline interactions. It helps prevent fraud, identity theft and misuse of personal data. Using a variety of methods and technologies (such as facial recognition and the use of public or private databases), identity verification compares and corroborates the information provided to ensure maximum validity and integrity.

What's the difference between an identity check and an identity verification?

While these two terms are often used interchangeably, there is a significant nuance between them. Identity checks are a specific practice that involves verifying supporting documents and information relating to a person’s identity as part of a legal procedure. This procedure is generally carried out by competent authorities such as law enforcement agencies (judicial police, police officers, security guards, etc.) after offences have been committed, or when required by law. For example,article 78.2 of the French Code of Criminal Procedure stipulates that customs officers are empowered to check the identity of travellers at the Schengen area’s borders “with a view to verifying compliance with the obligations to hold, carry and present permits and documents laid down by law”.

This control is generally carried out at the scene of the offence (on the road, in a public place, etc.) by the law enforcementIf you refuse or are unable to prove your identity, you can be detained for up to 4 hours at a police station by an OPJ (Officier de la Police Judiciaire), or at border control points by customs officers.

Identity checks can take different forms, depending on the context in which they are carried out. Commonly used methods include requesting the presentation of official documents (ID card, passport), comparing fingerprints or using modern technologies such as facial recognition.

The difference between an identity check and an identity verification can be summed up as follows:

- Identity checks are generally carried out by the relevant authorities (judicial police, customs officers, etc.) and focus on legal compliance.

- Identity verification can be carried out by various entities such as private companies or internet platforms, and aims to authenticate the declared identity using a variety of methods and technologies.

Who has the right to check or verify my identity?

Who can carry out an identity check?

Highly regulated companies such as banks and financial institutions are legally obliged to verify the identity of their customers and future customers: this is known as KYC (Know Your Customer). In order to combat fraud, money laundering and the financing of terrorism, this step is compulsory: for example, you can’t open an online bank account without the bank first checking your identity. For companies that are not subject to KYC, verifying identity is a process whose main aim is to combat fraud and/orautomate tedious paper-based processes. Artificial Intelligence technologies now make it possible to simplify and secure the process for both companies and customers.

Who can carry out an identity check?

Only officers of the judicial police (OPJ), judicial police officers under the responsibility of OPJs, certain deputy OPJs and customs officers (under certain conditions) are authorized to check your identity.

Please note that municipal police officers can record your identity when they observe a parking ticket, but are not authorized to check your identity. In other words, they can ask for your identity papers to complete the ticket, but they can’t check your identity.

Make an appointment with one of our experts to find out how Netheos solutions can help you verify the identity of your users, securely and without loss of conversion.

How do I check my ID online? Steps and processes

Steps for verifying a national identity card

Checking a French identity card

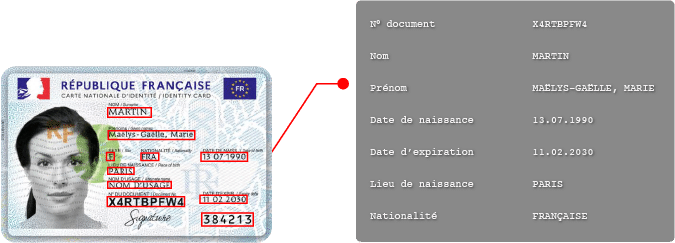

To verify an ID document remotely, several steps and processes are required. Here are the 6 steps involved in subscribing to an Internet service:

- Capture/scan the identity document: The first step is to capture or scan the identity document to obtain a usable electronic version. This can be done using a scanner, a camera or even a dedicated mobile app.

- Acceptability check: Once the document has been digitally captured, it is important to carry out an acceptance check to ensure image quality. This analysis validates the document’s legibility, taking into account criteria such as brightness and possible blurring. It is also essential to check that the type of document (identity card, passport, etc.) corresponds to that requested by the relevant services (banks, insurance companies, etc.).

- Data extraction: The third stage consists of extracting the data present on the identity document using optical character recognition (OCR). This technology converts the characters in the image into text that can be processed by algorithms.

- Data validation: Once the data have been extracted, it’s essential to validate them through careful analysis. This involves checking the conformity of the document’s Machine Readable Zone (MRZ) and comparing this information with the visual data itself. This step ensures the integrity of the information contained in the identity document.

- Checking document authenticity: The fifth stage consists of a thorough check of the document’s authenticity. This includes analyzing the overall design of the document, optical security features such as holograms and watermarks, as well as checking for potential anomalies in fonts, photography and the tones and colors used.

- Document consistency check: The final step is to check that the document is consistent with the information supplied by the user. This involves checking that the data present on the document corresponds to the information transmitted by the user, via a form for example. This control prevents fraud and intentional manipulation.

Checking an Italian identity card

In principle, the verification process for Italian identity cards is similar to that for French identity cards. Thus, the 6 steps listed above are identical for both ID documents. However, while the process is similar, the safety elements to be controlled are different. Indeed, each identity document has its own security features (micro perforations for the French passport, fixed font for the 1994 CNI, 2D-Doc for the 2021 CNI…). So, if RAD/LAD self-generating modular pipelines (i.e. the process of document recognition and reading by AI is self-generating: at each stage of analysis, it automatically recovers new information about the document) are identical for French and Italian ID documents, the control points (particularly in terms of authenticity verification) are different.

How can I check the authenticity of an identity document (passport, ID card, residence permit, etc.)?

- Examine security features: Most official identity documents, such as passports or ID cards, have built-in visual security features to prevent counterfeiting. You can use a magnifying glass or light source to examine details such as security patterns, holograms, micro-printing or UV-reactive ink.

- Check the paper and printing: Take a close look at the paper used for the identity document. The texture and consistency of the paper can give a clue to its authenticity. In addition, check the print quality by looking at the text and images on the document. Printing errors, such as blurred lines or offsets, can indicate a false document.

- Examine variable elements: Official documents often include variable elements such as the holder’s photograph, signature, or personal information that varies from one individual to another. Make sure these elements are correctly aligned and match those provided by the issuing authority.

- Check with a reliable source: Some government authorities offer Internet databases that allow you to check the authenticity of identity documents by entering the document number. Use these resources to confirm that the document presented is valid and has not been reported lost or stolen.

- Call in an expert: If you have doubts about the authenticity of an identity document, you can also consult an expert in the field. Some professions, such as police officers or fraud specialists, have expertise in this area and can help you check the document. Expert services such as Netheos use Artificial Intelligence to check the authenticity of all identity documents with even greater precision than humans.

How do I check the validity of an identity card?

To check the validity of an ID card and ensure its conformity, several steps can be taken:

- Check that your identity document has not expired. The expiry date must be visible and must not have passed. As a reminder, the CNI is valid for either 10 or 15 years, depending on the date of issue and your situation at the time. So, if your identity card was issued :

- Before 2014, if you were of age at the time of issue, the validity of your CNI has been extended by 5 years (from 10 to 15 years).

- Before 2014 and if you were a minor at the time of issue, your CNI is valid for 10 years (the expiry date is the one shown on the card).

- After 2014 and you have received theold model of CNI (blue plastic), the validity period of your CNI is extended by 5 years (from 10 to 15 years).

- After 2014, if you have received the new model of CNI (CB format), your CNI will be valid for 10 years.

- Check the general condition of the document. It must not be folded, torn or damaged in any way.

- Make sure the information on the identity document is legible. Particular attention must be paid to essential information such as the holder’s surname, first name and date of birth. These elements must be clearly visible and free of any erasures or alterations.

For professionals specializing in ID card verification, there are also technological devices such as scanners or optical readers that can confirm the integrity of the card and the authenticity of the data recorded on it.

Find out more by downloading our free replay of the Webinar entitled “Webinars & Replays”.Online underwriting: automate your customers’ voucher checks with AI”

Webinar

OCR technology to verify identity documents

What is OCR? Definition

OCR, or Optical Character Recognition, is a technology that converts printed text (such as that on an identity document) or handwritten text into electronic text. This conversion is achieved using advanced image processing and Artificial Intelligence techniques.

In the case of CNI verification, for example, OCR converts the visual data on the captured document or photocopy, such as name, date of birth, expiration date or MRZ, into editable digital text data. In this way, the name Martin on a CNI can be correctly broken down into several legible letters: M-a-r-t-i-n.

To give you an idea,OCR works exactly like the eyes and brain of a human being:

- When you look at a piece of identification, your eyes will transmit raw visual information to your brain. The brain then receives and analyzes the visual information, transforming it into information that can be understood by humans: text, letters, an image…

- OCR works in the same way, except that the eyes and the brain are replaced by 2 AIs: the first AI will convert a raw image (the text area of an NIC) into a signal that can be understood by a 2nd AI, which will take care of giving it meaning (text, letters that can be edited in digital format).

This technology was originally developed to facilitate the search and indexing of paper documents, enabling text searches within them. However, it also offers practical applications in the field of identity verification and control.

Thanks to OCR, it is possible toautomate the identity verification process by digitizing identity documents such as identity cards, passports, driving licenses or residence permits. The information contained in these documents, such as name, date of birth or identification number, is then automatically extracted by the OCR algorithm.

This automation enables faster, more reliable verification of the information contained in the identity document. What’s more, it reduces the human errors associated with incorrect manual input.

How does OCR work? CNI verification

Extracting data from an identity document, such as a Carte Nationale d’Identité (CNI), using Optical Character Recognition (OCR) technology involves several important technical steps, each using advanced Deep Learning techniques. Here is an exhaustive list of the key steps involved in this process:

- Locating the NIC in the image: the aim is to remove the background of the photo showing the NIC, leaving only the NIC in the image.

- Cancellation of geometric deformations: the capture of an ID document by a cell phone camera, for example, is never completely straight. The image of the NIC is then often “distorted”, vertically, horizontally or in depth. The aim is then to cancel and correct the geometric deformations to flatten the NIC.

- Locating the document’s text zones: the aim is to locate the data zones (MRZ, name, date, etc.) in the photo of the NIC.

- Reading the document’s text: the OCR can then extract and convert the map’s pixel data into digital text data.

What's the MRZ band?

The MRZ band, also known as the Machine-Readable Zone, is a zone found on passports, ID cards and other official documents. It is usually located at the bottom of the login page.

This is a special section containing certain key information in machine-readable format. This information is encoded as alphanumeric characters that can be easily processed by automated systems such as scanners or optical character recognition (OCR) software.

The MRZ strip is divided into several lines, each providing specific details of the document holder’s identity. Typically, the first line contains the country issuing the document, while the second contains the document number and expiry date. The third is used to store first and last names.

The data contained in the MRZ band is crucial for authentication and identity verification. They enable automated systems to quickly and accurately read the essential information needed to verify an identity.

Remote identity verification solutions

Netheos, AI and human expertise for identity verification

Netheos is the Namirial group’s artificial intelligence center of excellence, with particular expertise in identity verification since 2004.

The Montpellier-based company now offers a range of solutions in SaaS mode for its customers (i.e. La Banque Postale, CDC Habitat, Floa Bank, Infogreffe, CNP Assurances and many others…) with two clear objectives:

- Simplify and secure identification processes for companies and their customers

- Completely eliminate the risk of fraud

To achieve this, Netheos relies on a strategic alliance between cutting-edge Artificial Intelligence technologies and an in-house team ofanti-fraud experts, trained by specialists (customs officers, border police, national printing works).

Here are the 4 Netheos identity verification solutions:

- Netheos ID: The solution for companies with few or no regulatory constraints. Analyze all ID documents in 3 seconds, thanks to reliable, fast and consistent artificial intelligence, 95% without human verification.

- Netheos ID+: Eliminate the risk of identity theft with our ®Facematch Photo facial recognition technology! The fully-guided path gives you a very high conversion rate, with an average completion time of 48 seconds.

- Netheos ID FAST: This solution enables you to combat identity theft and benefit from the highest conversion rate, thanks to our ®Facematch Video identity verification solution with facial recognition in less than 40 seconds, offering the best user experience on the market. This remote identity verification solution is specifically designed for the eIDAS-certified Qualified Electronic Signature (QES) path.

- Netheos ID MAX: Verify your identity remotely with our PVID course, currently being certified by ANSSI. The combination of AI and people, available 24/7 and based in France, with an end-to-end journey in less than 2 minutes. This remote identity verification solution is designed for the ANSSI-certified PVID course.

Make an appointment with one of our experts to find out how Netheos solutions can help you verify the identity of your users, securely and without loss of conversion.

What is the France Identité application?

France Identité is a digital solution developed by the French authorities to facilitate identity verification and control. It enables French citizens to store their identity information in a secure electronic format and share it with third parties in a confidential manner.

The France Identité solution offers a range of features enabling users to manage their digital identity easily and efficiently. Users can store the digitized version of their identity documents (CNI or passport), enabling them to access them quickly and easily at any time, without having to worry about misplacing or damaging them. In addition, France Identité uses advanced encryption and authentication mechanisms to guarantee data confidentiality and security. This ensures that only authorized persons have access to stored personal information.

One of the main uses of France Identité is identity verification for Internet transactions or exchanges with third-party organizations requiring reliable identification. For example, when a user wishes to open a bank account on the Internet, they can use the application to share their identity information with the bank securely and without having to provide paper copies.

Use of identity verification and use cases

Identity verification is mainly used by companies in the public and private sectors for two purposes: to meet a regulatory requirement for Know Your Customer (KYC) and/or to simplify, automate and secure a customer relationship process. Let’s take a look at its use cases by industry.

Meeting KYC requirements for identity verification

As part of a KYC (Know Your Customer) process, identity verification is an essential element and a legal requirement for industries such as banking, insurance and the crypto-currency sector. It enables us to verify the true identity of our customers, and to combat illicit activities such as money laundering and the financing of terrorism(LCB-FT regulation).

Banks

- Opening a bank account: make sure that the person wishing to open an account is who he or she claims to be.

- Obtaining credit: minimizing the risk of money laundering or fraud.

- International transactions: when funds are transferred between different jurisdictions.

Crypto-currency

- Verification of users on exchange platforms before they can carry out large transactions, in order to comply with current regulations. An identity check on Binance, for example, is mandatory.

- For ICOs (Initial Coin Offering): guarantee the transparency and legality of the operation.

- Wallets: guarantee the security of stored digital assets and prevent theft or loss through unauthorized access.

Insurance

- Insurance underwriting: whether for auto, home or medical insurance, we assess their risk profile and determine the appropriate rates.

- Claims processing: ensuring that claimants are the rightful beneficiaries of compensation.

Industry use of identity verification without KYC

Education

- Taking part in online exams

- Registration with the school department (business school, university...)

Remote services

- Age verification (for pornographic sites, for example)

Transport

- Pre-arrival check-in at the airport

Health

- Access to medical records

- Electronic prescription

Collaborative economy (Airbnb, Uber...)

- Verifying the Airbnb identity of hosts and travelers: guaranteeing security and trust between parties prior to a transaction

- Payment checks to ensure that the credit card used for the reservation corresponds to the user's identity.

- Checking the identity of drivers on Blablacar or Uber

Identity verification and regulatory compliance

Customer knowledge (KYC): a legal obligation

Know Your Customer (KYC) is the procedure that companies in regulated sectors such as banking, financial institutions, insurance and real estate must follow to verify the identity of individuals before initiating any commercial approach with them. In practical terms, KYC is the legal process of verifying identity, enabling companies to ensure that the applicant is who they claim to be. This approach is governed by law: the AML5 (5th European LCB-FT Directive) and eIDAS regulations.

A tool in the fight against fraud

Still linked to the KYC process, the primary aim of identity verification is to combat fraud (financial, documentary and identity-related) and money laundering and the financing of terrorism (LCB-FT).

In today’s digital age, remote identity verification tools such as the 4 offered by Netheos completely eliminate the risk of identity theft. financial, social, identity or document fraud thanks to Artificial Intelligence technologies combined, for the most secure solutions, with a 24/7 anti-fraud expert service based in France.

Fill in the form and we will contact you as soon as possible.

You can discover :

- How we can meet your specific needs and expectations

- A personalized demo, allowing you to appreciate the fluid experience we offer

- Customer feedback and case studies of similar companies that have integrated our solutions

- Advantages, benefits and value according to your use case