How do you define fraud?

Definition of fraud

Fraud can be defined as a deliberate action aimed at deceiving, duping or swindling someone in order to obtain an illegitimate personal advantage. It generally involves the use of illicit means, such as falsifying documents, manipulating data or deceiving people in order to obtain money, goods, services or any other form of material advantage.

What is considered fraud?

To qualify as fraud, the act in question must have been committed intentionally. This requirement is also a fundamental principle of criminal law: according toarticle L121-3 of the new Penal Code, “there isno crime or misdemeanor without the intent to commit it“. However, assessing the intentional element can be particularly tricky in practice. Thus, according to the aforementioned standard, an unintentional inaccuracy in the accounts – even if material – constitutes an error and not fraud.

To be considered a fraud, it is therefore important to take several elements into account:

- The commission of an act: Fraud always involves a concrete act rather than a mere idea or intention.

- Willfulness: The fraudulent act must have been committed deliberately and intentionally.

- Assessment: Intentionality can be difficult to prove legally, as it is based on subjective elements such as the fraudster’s intentions and motivations.

- Unintentional vs. Intentional: Unintentional errors are not considered fraudulent practices, even though they can have significant consequences.

What's the difference between error and fraud?

While both involve incorrect behavior, they differ in intent and impact.

An error is generally the result of an involuntary action or negligence. It can occur due to misunderstanding, distraction or lack of skill. The consequences of an error may vary depending on the context, but they are rarely intentional and can often be corrected with appropriate measures.

Fraud, on the other hand, implies a deliberate intention to deceive or harm others. It is based on a deliberate act aimed at obtaining an unfair advantage or causing losses to a third party. Fraud can take many forms, such as falsification of documents, accounting manipulation, misappropriation of funds or fraudulent use of goods or services.

Thus:

- A mistake is unintentional, while fraud is deliberate.

- Errors are the result of negligence or misunderstanding, while fraud aims to deliberately mislead or cause damage.

- An error can usually be corrected, whereas fraud can lead to serious consequences and financial loss.

What's the difference between fraud and corruption?

Fraud and corruption are two distinct concepts, although they are often associated due to their similar characteristics. Here are a few key points to differentiate these two concepts:

Definitions

- Fraud can be defined as a deliberate action aimed at deceiving or misleading others in order to obtain an illegal or unjustified advantage. It often involves the manipulation of information or goods.

- Corruption, on the other hand, is when a person in a public or private positionabuses his or her power in exchange for a personal advantage or to further the interests of a third party.

Players involved

- Fraud can involve individuals as well as entire organizations acting in their own self-interest.

- Corruption usually involves government officials, civil servants, managers of state-owned companies and sometimes even politicians.

Methods used

- Fraud can take many forms, depending on the context, such as financial embezzlement, counterfeiting, misappropriation of funds or identity theft.

- Corruption is mainly based on the use of bribes, favoritism and misappropriation of public funds.

Legal consequences

- Both offences are generally prosecuted and punished by law, although sanctions and penalties may vary according to the seriousness of the act committed and the jurisdictions involved.

Make an appointment with one of our experts to find out how Netheos solutions can help you verify the identity of your users, securely and without loss of conversion.

What are the different types of fraud?

Financial fraud

- Credit card fraud: Unauthorized use of a credit or debit card to make payments.

- Accounting fraud: Manipulation of a company’s financial figures to conceal losses or exaggerate profits.

- Stock market manipulation: Action aimed at manipulating the price of a share or security on the financial markets in order to make an illegitimate profit.

- Money laundering: The process by which illegally acquired money is made legal by concealing it in legitimate financial transactions.

- Tax fraud: The practice of illegally evading or avoiding payment of taxes owed to the State.

- Insurance fraud: Submitting false insurance claims in order to obtain undue reimbursement.

Identity fraud

- Identity theft: The act of impersonating another person in order to gain access to their personal information, commit crimes or engage in fraudulent activities in their name.

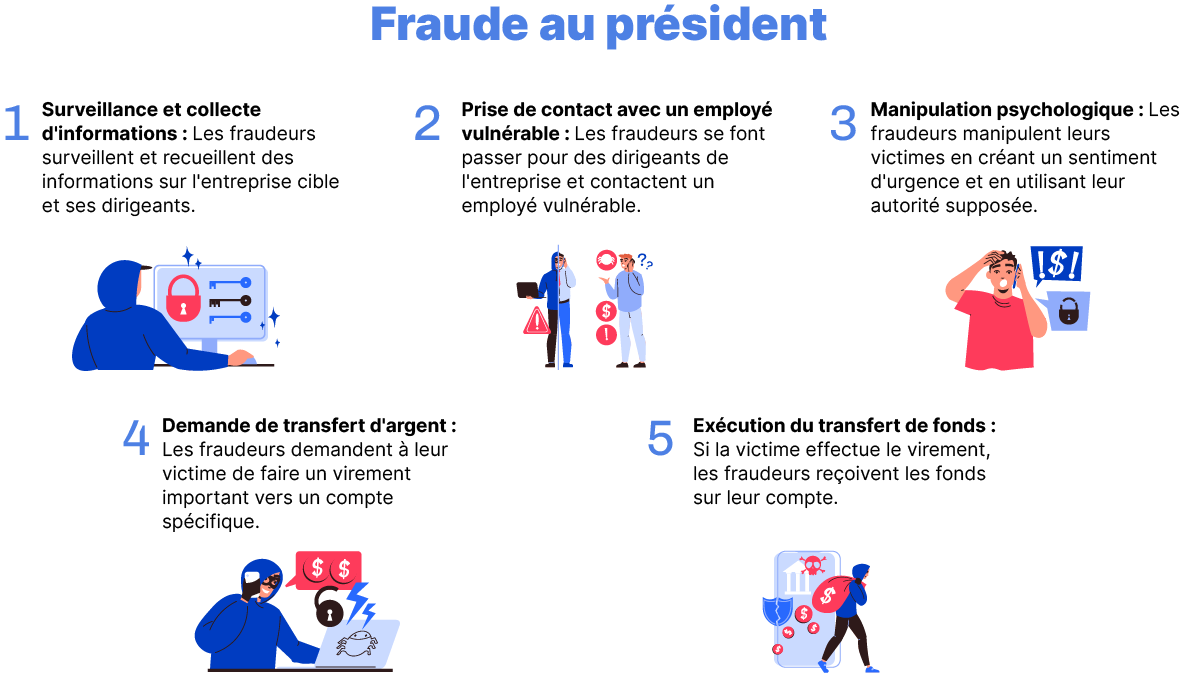

- Chairman fraud: Also known as CEO fraud or emergency fraud, this is a practice in which fraudsters pose as a senior manager or trusted third party to trick the executive into making large fund transfers.

Document fraud

- Banknote counterfeiting: The manufacture and use of counterfeit banknotes to deceive individuals or financial institutions.

- Falsification of official documents (passports, driving licenses, etc.): Production and use of falsified official documents in order to usurp an identity or gain access to certain privileges and advantages.

- Falsification of administrative documents (invoices, income, etc.): Production and use of falsified administrative documents to obtain undue financial advantages or to avoid certain obligations.

- Falsification of diplomas or certificates: Creation and use of false diplomas or certificates in order to obtain employment, promotion or professional benefits that are not legitimately deserved.

Social fraud

- Misrepresentation of income or family situation: The practice of lying about one’s income or family situation in order to obtain undue financial benefits.

- Social benefits fraud (CAF, Pôle Emploi, Social Security fraud): Fraudulently obtaining social benefits by falsely claiming to be eligible in order to receive undue monthly payments.

- Concealed work: The illegal practice of carrying out a professional activity without making an official declaration to the tax and social authorities.

Commercial fraud

- Product or service deception: Deceptive commercial practice consisting of lying about the characteristics, quality or advantages of a product or service in order to mislead consumers.

- Price manipulation: Action aimed at artificially influencing prices on a market in order to maximize profits, often at the expense of consumers (for example, during sales: the discounted price is actually the same as the original price).

- Product counterfeiting: Production and sale of counterfeit products that imitate famous brands, thereby infringing intellectual property rights.

- Misleading advertising: Dissemination of false or misleading information as part of an advertising campaign to induce consumers to buy a product or service.

- Unfair competition: Illegal business practice consisting of adopting unfair strategies with the aim of harming competitors and gaining an unfair advantage in the marketplace.

Computer fraud / cybercrime

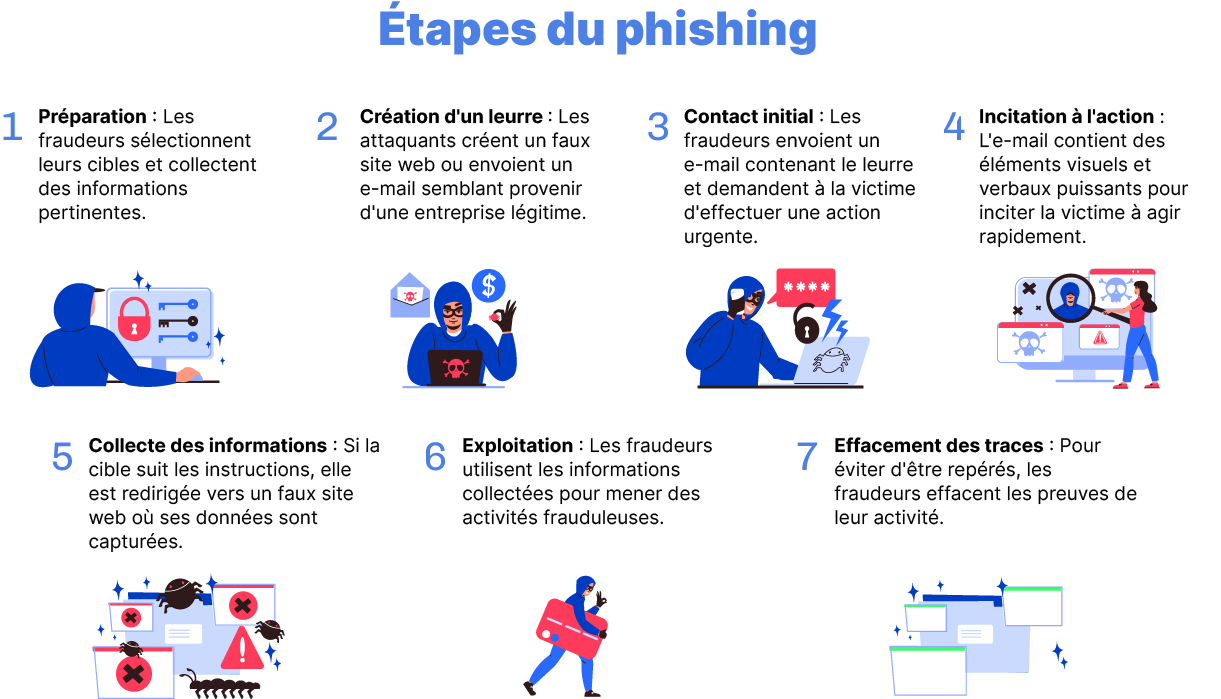

- Phishing: Fraudulent practice involving the use of falsified e-mails, text messages or websites to steal users’ sensitive personal information.

- Malware and ransomware: Use of malware and viruses to gain illegal access to computer systems, steal personal information or take control of a computer without the owner’s consent.

- Denial of service attacks (DDoS ): A type of attack designed to overwhelm a specific website or network by generating massive amounts of traffic, making the service unavailable to legitimate users.

Online fraud

- Online sales scams: The practice of deceiving buyers by selling them non-existent products or services, of poor quality or not conforming to the advertised description.

- Pyramid sales or Ponzi scheme: Illegal mechanism whereby participants are remunerated primarily through the recruitment of new participants rather than through the actual sale of products or services.

- Fake lottery or inheritance scams: Attempted frauds in which victims are told they have won a lottery or inherited a large sum of money, but must pay a fee to access their winnings.

- Online romance scam: A practice in which fraudsters establish online relationships with the aim of swindling their partners, often asking for money under the pretext of a difficult situation.

What to do in the event of fraud

What to do if you are a victim of fraud?

When faced with a fraud situation in France, it’s vital to take appropriate measures to protect your interests.

Whatever the type of fraud, the first step is always to contact the local police or gendarmerie to provide them with all the relevant details, such as dates, amounts of money involved and available evidence. Be sure to keep a copy of the incident report for your records.

Here are the steps you can take if you are a victim of fraud, depending on the type of fraud:

Bank card fraud

Report fraud on Perceval

After informing the local police or gendarmerie, it is strongly recommended to report it to Perceval, an online service managed by the French Ministry of the Interior.

Block your bank card immediately and inform your bank

You must block your card (or temporarily deactivate it) and stop payment! This means your credit card can no longer be used. To do this, go to the personal area of your bank's website or application, generally to the section concerning your bank card. You should also inform your bank of any details of the fraud, including suspicious transactions and any compromised bank accounts or cards. Your financial institution may then take steps to block or cancel these fraudulent transactions.

Check your bank statements regularly

You should carefully check all your recent financial transactions to identify any suspicious or unauthorized activity. If you spot transactions that are not yours, report them immediately to your bank and follow their instructions.

Identity fraud (impersonation)

Contact all credit providers immediately

You must cancel all your cards and direct debits, with the exception of regular debits such as rent or electricity.

File a complaint with the appropriate authorities

This will not only prove your good faith in the event of subsequent problems, but also initiate a potential search for possible suspects. To do this, go to your nearest police station or gendarmerie and lodge a complaint against X for identity theft. You can also send your complaint directly to the Public Prosecutor. It's essential to have a copy of this complaint, as you'll be asked for it when dealing with banks or government agencies. An official database of identity theft victims has been set up by the national police force, and is accessible only to law enforcement officers.

Cancel your stolen ID and apply for a new one.

Check that you are not registered with the Banque de France

Fichier central des chèques and Fichier des incidents de remboursement des crédits aux particuliers.

Computer fraud

Change all your passwords and strengthen the security of your online accounts

If you suspect your credentials have been compromised, it's crucial to change your passwords immediately and activate additional security measures, such as two-factor authentication.

Online fraud

Report the incident to the relevant platform

Major online service providers, such as social networks or e-commerce sites, generally have specific procedures for reporting and dealing with cases of fraud ("Report abuse" or "Report an ad").

Commercial fraud

Inform the fraud control authorities

If you notice any infringements of consumer protection rules (misleading advertising, price manipulation, counterfeiting, etc.), it's important to inform the DGCCRF (Direction générale de la concurrence, de la consommation et de la répression des fraudes) immediately. This report may concern a store, a website or a company. After investigation, the government department can require commercial fraudsters to comply with their obligations, or face sanctions.

Remember that each fraud situation can be unique, so it’s important to follow the specific instructions listed by the relevant authorities and your financial contacts. Quick action is often crucial when it comes to minimizing the damage caused by fraud, so don’t delay if you fall victim to such a situation.

How do you spot fraud? Useful tips and sites

Find out about the blacklist of financial entities

The ACPR and AMF regularly update their blacklist of sites and entities offering unauthorized credit, savings books, payment services or insurance contracts in France. With its intuitive search engine, the Insurance, Banking and Savings (ABE) Info Service website lets you check in just 1 click whether the person or company you are contacting is authorized to offer such a service or product in France.

Website: https: //www.abe-infoservice.fr/liste-noire/listes-noires-et-alertes-des-autorites

Travelling in Europe

If you want to discover Europe, it’s important to protect yourself against Internet scams! The European Consumer Centre’s website helps you understand your rights and gives you lots of advice for a worry-free trip!

Site:

www.europe-consommateurs.eu

Protecting yourself against online fraud

Discover the everyday reflexes you need to adopt to protect yourself against cyber-risks (online scams, money extortion, e-mail or social networking account hacking, phishing, sentimental scams, Ponzi schemes…).

Website: www.lesclesdelabanque.com for cyber security tips and reflexes

Website: www.service-public.fr/particuliers/vosdroits/N31138 to file a complaint ( THESEE platform) or report an Internet scam ( PHAROS platform)

Tel

Info Escroqueries on 0 805 805 817 (free call Monday to Friday, 9am to 6.30pm) for help and support.

Protecting yourself against commercial fraud

The DGCCRF offers a range of anti-scam tips to help you protect yourself and report abusive, misleading or deceptive commercial practices.

Website: www.economie.gouv.fr/dgccrf/infos-arnaques

Report spam (unwanted, unsolicited commercial emails)

Spam can be of a marketing nature (commercial e-mail received without your consent – opt-in -) or cybercriminal by phishing (e-mails resembling those generally sent by a real company – bank, merchant site… – asking you for personal, banking or identity information).

Website: www.signal-spam.fr

Combating online shopping scams

You have made a purchase on an e-commerce site that is a member of FEVAD and you notice a scam (counterfeiting, deception on product characteristics, etc.). Failed to make first contact with the seller? Before going to court, you can settle your dispute amicably by contacting the Médiateur de la Fédération e-commerce et vente à distance (FEVAD) free of charge.

Ombudsman’s website: www.mediateurfevad.fr

List of Fevad members

w ww.fevad.com/annuaires-sites-marchands

Find out more by downloading our free replay of the Webinar entitled “Webinars & Replays”.How does AI help you reduce your underwriting fraud?”

Webinar

How do I get my money back after a fraud?

Who is liable for bank fraud?

In 2023, the bank is liable and must reimburse the user in the event of bank fraud if, and only if, the user can prove that the attack was not due to negligence on its part. As a result, both the user and the bank now have obligations of vigilance: they must take preventive measures to secure their personal data (login, password) and inform their bank as soon as possible of the fraud they have just been the target of.

However, this balance has not always been so clear-cut: explanations!

Before 2017, jurisdictions were rather lenient towards users who were victims of bank fraud. They relied heavily on the French Monetary and Financial Code (CMF) to demand repayment of transactions contested by the banks. The courts emphasized that banks had a duty to carefully monitor transactions on their customers’ accounts throughout the business relationship. As a result, bankers had to exercise their duty of vigilance in accordance with their rights and obligations.

All a user who had been the victim of bank fraud had to do was invoke article L133-18 of the French Monetary and Financial Code: “In the event of an unauthorized payment transaction reported by the user under the conditions set out in article L. 133-24, [la banque] reimburse the payer for the amount of the unauthorized transaction immediately after becoming aware of the transaction or after being informed of it, and in any event no later than the end of the next business day“.

Once the fraudulent transaction had been reported , the bank was legally obliged to reimburse the amount of the disputed transactions, as well as the interest and fees associated with them.

How can you prove bank fraud if the bank refuses to reimburse you?

Since the January 18, 2017 ruling by the French Supreme Court (Cour de cassation), the onus has been on the bank to provide evidence of negligence on the part of the user in the event of a refusal of repayment. On November 12, 2020, a new ruling by the French Supreme Court (Cour de cassation) specifies that, in addition to this evidence, the bank must now prove the absence of a technical deficiency (computer problem linked to its payment device) at the time of the facts. However, it remains essential for the user to prove her innocence by gathering all the evidence at her disposal.

First of all, judges base their assessment of gross negligence in bank fraud on factual elements. The latter is assessed independently of the victim’s personal characteristics, such as age or perception of fraud, or level of computer literacy. So, whether or not you’re aware of the risks of phishing attacks, the court won’t look to see if you’re an expert in cybercrime or a complete novice in the field.

Here are the questions you need to answer to build a strong case for bank fraud:

- Have you replied to a fraudulent e-mail requesting your bank card number, expiry date and cryptogram on the back of the card, as well as information about your cell phone account (in order to access the 3D Secure code)?

- Did you realize that the e-mail requesting confidential identification information was fraudulent?

- Have you checked the origin, spelling and syntax of the mail you receive?

- Were you quick enough to contact your bank directly after you suspected fraud?

By behaving attentively, the court could potentially consider that you have taken all reasonable measures of vigilance. You will then be refunded at least the full amount illegally taken from your account.

Make an appointment with one of our experts to find out how Netheos solutions can help you verify the identity of your users, securely and without loss of conversion.

How to prevent fraud?

Fighting fraud is everyone’s business! For individuals, it’s a question of adopting an attentive attitude and keeping abreast of the various fraudulent practices that exist. To help the competent authorities take punitive measures, it is also necessary to report them as soon as possible.

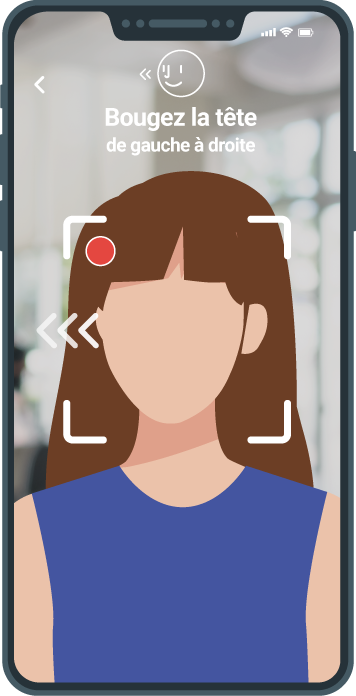

For professionals, anti-fraud solutions are governed by law. For banks, insurance companies, fintechs and real estate firms, it’s even a regulatory requirement: they have to set up remote identity verification solutions respecting regulations KYC (Know Your Customer) to combat money laundering and the financing of terrorism (LCB-FT), or Anti-Money Laundering (AML).

Fill in the form and we will contact you as soon as possible.

You can discover :

- How we can meet your specific needs and expectations

- A personalized demo, allowing you to appreciate the fluid experience we offer

- Customer feedback and case studies of similar companies that have integrated our solutions

- Advantages, benefits and value according to your use case