Before tackling the subject of fighting fraud, it’s important to agree on the definition of fraud: a deliberate and intentional action aimed at deceiving, duping or swindling a person or entity in order to obtain illegal benefits, usually at the expense of others. There are many types of fraud, which can be grouped into 7 categories: financial, commercial, identity, documentary, social, IT and online.

The fight against fraud (or rather, frauds) is therefore all the actions and measures put in place to prevent, detect and punish these fraudulent acts. It involves various stakeholders such as public authorities, private companies and individuals themselves. The practice is governed by national, European and international laws and regulations.

The law to combat fraud

What is the main challenge in the fight against fraud?

Since the Covid-19 crisis and its consequences on the digitalization of society, the risk of fraudulent acts has increased considerably. According to an Euler Hermes – DFCG study for the year 2021, 3 out of 5 companies are observing an increase in fraud attempts, including 3 out of 4 by phishing. In the same year, 1 company in 4 was the victim of a proven fraud.

In an ever-changing digital world where new forms of fraud regularly emergeThe main challenge in the fight against fraud is to protect individuals, companies and institutions from illegal and fraudulent activities, in order to ensure the security of our customers. trustintegrity and transparency of commercial, financial and digital transactions.

An effective fight against fraud requires a thorough understanding of the techniques used by fraudsters, as well as the implementation of preventive and repressive measures.

What laws and regulations govern the fight against fraud in France?

In France, it is based on a rigorous legal framework. Here are the main laws and regulations to combat this scourge. Please note that this list is not exhaustive.

The Hamon Law

- Adopted in 2014, the Hamon Law aims to strengthen consumer protection and promote fairer commercial practices.

- This law introduces several specific measures to prevent fraudulent practices in online sales. For example, it requires e-commerce sites toclearly display information on the products and services on offer, including their essential characteristics, total price (including VAT), delivery and payment terms and conditions for exercising the right of withdrawal.

- In addition, the Hamon Law also strengthens penalties for misleading or aggressive commercial practices. It provides for fines of up to 15% of the average annual sales made in France by the company concerned.

- Legal code: Code de la consommation

The Sapin 2 Act

- Enacted in 2016, the Sapin 2 Act aims to strengthen transparency and ethics in economic life.

- With regard to tax fraud, this law grants extensive powers to the competent authorities to investigate tax offences and recover fraudulent assets.

- Among its key provisions are the creation of the French Anti-Corruption Agency (AFA) to prevent and detect acts of corruption, and the deployment of a “whistleblowing” system to encourage the reporting of fraudulent acts.

- Legal code: Code monétaire et financier

The 4th LCB-FT Directive

- The 4th European Directive aims to combat money laundering and the financing of terrorism.

- This directive imposes strict obligations on professionals in the financial sector, such as banks, insurance companies, notaries, lawyers, estate agents, etc., in terms of customer due diligence.

- These obligations include the identification and verification of customers’ identity (KYC), the ongoing monitoring of their financial movements (KYT), and the reporting of suspicious transactions to the relevant authorities (notably TRACFIN and the AMF).

- Legal code: Code monétaire et financier

Make an appointment with one of our experts to find out how Netheos solutions can help you verify the identity of your users, securely and without loss of conversion.

The 5th LCB-FT Directive

- The 5th European LCB-FT Directive (also known as AMD5) reinforces existing measures to combat financial fraud.

- In particular, it imposes heightened vigilance by specifying the additional measures to be implemented in the event of a remote business relationship.

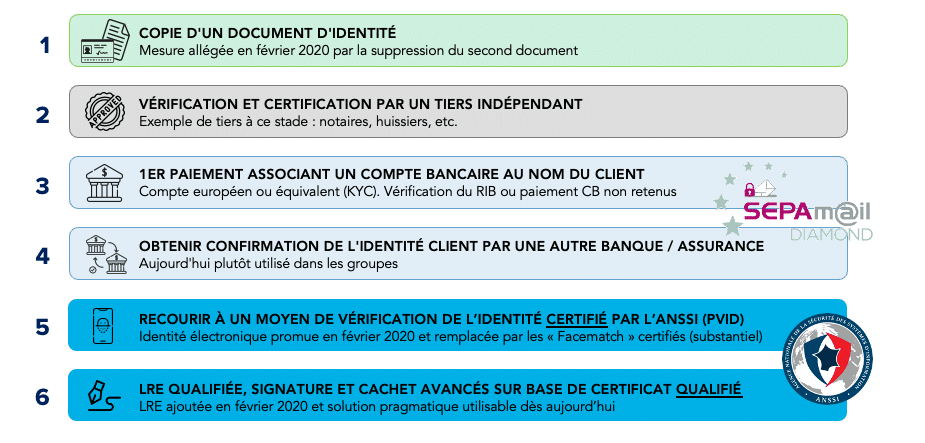

- These measures include the obligation for companies subject to the law to use ANSSI-certified solutions to verify their customers’ identity (Qualified Electronic Signature, PVID path, Digital Identity, etc.).

- Legal code: Code monétaire et financier

The Law for Confidence in the Digital Economy (LCEN)

- Adopted in 2004, the LCEN regulates online activities and aims to prevent fraudulent actions on the Internet.

- It requires online service providers to put in place appropriate security measures to protect users’ personal data.

- The law also includes specific provisions to combat spamming (unsolicited mass marketing or cybercriminal e-mails) and illegal content on the Internet.

- Legal code: Code de commerce

The Law for the Modernization of the Economy (LME)

- The LME, enacted in 2008, aims to promote competition and improve market functioning.

- It contains specific provisions to prevent fraudulent commercial practices, such as abuse of a dominant position or illicit agreements between companies.

- For example, this law strengthens the powers of the French Competition Authority to investigate anti-competitive practices and impose penalties on offending companies.

- Legal code: Code de commerce

What is the law of October 23, 2018, known as the "anti-fraud law"?

The law of October 23, 2018 on the fight against fraud is a legislative text that aims to improve the detection and repression of fraud. While the law for a State at the service of a society of trust (ESSOC) aimed to simplify the administration’s relations with users, notably via the introduction of a right to error, the law of October 23, 2018 completes it by strengthening sanctions against tax evaders (whose action is no longer an error but deliberate).

This law has two main objectives: to better detect and apprehend fraud, and to better punish it. To achieve these objectives, the text introduces several significant innovations:

- The creation of a "tax police" within the Ministry in charge of the Budget, to enhance judicial investigation capabilities in cases of tax fraud.

- Strengthening Customs' powers to combat fraudulent software designed to enable and conceal fraud.

- Improved collaboration between agents responsible for combating fraudulent practices on control and recovery missions.

- Clarifying the tax obligations of collaborative economy platforms in order to better exploit the data collected by the tax authorities and improve their ability to detect undeclared income.

Penalties for fraud have also been increased:

- Automatic application of the "naming and shaming" practice, aimed at making public the judge's sentences (tax reminders and administrative monetary penalties) for the most serious cases of tax fraud.

- The creation of an administrative penalty (in addition to existing financial penalties) for professionals complicit in tax fraud.

- Increasing fines to 2 times the amount obtained from tax fraud.

Webinar

Find out more by downloading our free infographic entitled “5 levels of control to stop identity fraud on the Internet”

Who's fighting fraud?

Players in the fight against fraud in France and the EU

In France, several players play an essential role. Here’s a list of the main players involved.

- Public authorities The French State, through various institutions such as the Ministry of the Economy and Finance, the General Directorate of Public Finance (DGFiP) and the General Directorate of Competition, Consumer Affairs and Fraud Control (DGCCRF), is responsible for implementing policies and measures to combat fraud. These authorities are responsible for detecting, preventing and punishing fraudulent acts.

- Law enforcement: Police and gendarmerie forces are also involved. They are responsible for investigating reported cases of fraud, apprehending suspected fraudsters and collecting the evidence necessary for prosecution.

- Control bodies: Several independent bodies are responsible for regulation in different sectors. For example, the Autorité des marchés financiers (AMF) ensures that financial market transactions are carried out in compliance with the rules in force, while the Autorité de contrôle prudentiel et de résolution (ACPR) supervises banking activities and ensures user protection.

- Private sector professionals: Companies such as banks and insurance companies have an important role to play: they need to implement internal protection measures to safeguard their activities and customers against potential malicious actions. This can include the use of advanced solutions such as those offered by Netheos to detect fraudulent schemes, thanks to a strategic alliance between AI and human expertise.

- Associations and non-governmental organizations: Some NGOs are specifically dedicated to the fight against fraud. They provide information, advice and support to fraud victims, raise public awareness of the risks associated with fraud, and advocate stricter policies to combat this scourge. One example is the well-known association “30 millions de consommateurs”.

- European institutions: The European Commission plays a key role in coordinating efforts at EU level. It is responsible for developing policies and regulations to prevent and combat fraud. The European Anti-Fraud Office (OLAF) is also an important institution, investigating cases of fraud affecting EU finances.

How do banks combat fraud?

To combat fraud, money laundering and the financing of terrorism (LCB-FT), banks must implement a Risk and Compliance Management strategy. To do this, they must apply a set of measures to verify the identity and authenticity of their prospects: this is known as Customer Due Diligence (CDD).

As part of this process, banks are legally obliged to :

- Know your customer (KYC process)

- Clearly identify their transactions (KYT or Know Your Transaction process).

On top of this, banking institutions are implementing a range of additional measures to actively combat fraud. Here are the 5 main actions:

-

Implementation of advanced security systems

Investment in cutting-edge technologies such as Netheos' remote identity verification solutions using facial recognition with active or passive live detection. These tools are generally used when the bank enters into a relationship with its customers (for example, when opening a bank account), in order to comply with KYC obligations. In particular, these methods eliminate the risk of identity theft (the practice of deliberately assuming another person's identity in order to carry out fraudulent actions).

-

Strengthening authentication protocols

Multiple layers of authentication to ensure that only authorized people can access an account or perform sensitive operations. These measures, known as strong authentication, often include the use of complex passwords, double authentication (password + validation by email, for example, or receipt of a code by SMS) and notifications in the event of a suspicious connection from an unknown device.

-

Continuous transaction monitoring

To comply with KYT obligations, banks use advanced analysis tools to monitor transactions carried out on their platforms in real time. This enables them to quickly identify any unusual or fraudulent activity and intervene immediately to minimize the risk.

-

Cooperation with the relevant authorities

Close collaboration with law enforcement agencies (notably the ACPR and AMF) to exchange crucial elements (such as blacklists or the list of Politically Exposed Persons) and cooperate in fraud investigations. This collaboration strengthens the detection and suppression of fraudulent activities.

-

Awareness-raising and training

Banks provide regular training for their staff to raise awareness of new fraud techniques and inform them of the steps they need to take to identify and report suspicious cases. They also educate their customers, advising them on how to protect their sensitive data.

Make an appointment with one of our experts to find out how Netheos solutions can help you verify the identity of your users, securely and without loss of conversion.

How can we effectively combat fraud today?

Fraud doesn’t just concern financial companies: it’s everyone’s business, and it’s evolving at the same pace as new technologies! Whether you’re an individual or a professional, it’s important to implement preventive and curative measures.

How to combat bank fraud?

As an individual, it’s essential to take steps to combat bank fraud. Here is a comprehensive list of recommendations to help you protect your financial information:

Be alert to suspicious e-mails and calls

- Never respond to requests for personal or financial information by e-mail or telephone, especially if they appear to come from your bank or other financial institutions. Financial institutions will never ask you to provide your bank details, credit card codes or login details by e-mail, telephone or SMS.

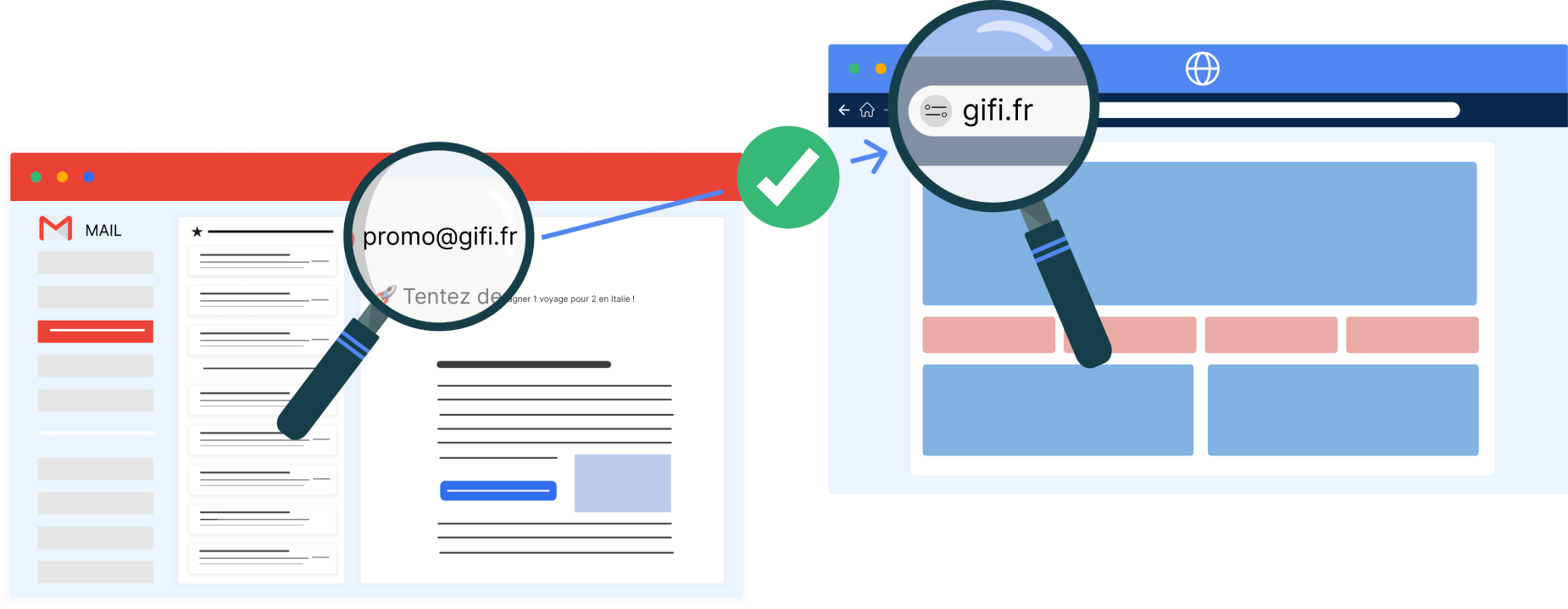

- Always check the sender’s identity: the domain name of the email address (the part after the @) is usually misleading. Check that it corresponds exactly to the domain name of the sender’s site (the part after www.). For example, if you receive an email from Gifi, it will probably be authentic if the email address is @gifi.fr, since their website is www.gifi.fr. If, on the other hand, the domain name is @gifi-promo.fr, it’s probably a phishing scam.

- Don’t click on suspicious links or download attachments from unknown senders.

Use strong passwords

- Opt for complex, unique passwords for each of your bank accounts.

- Whenever possible, mix numbers, upper and lower case letters and special characters.

- Avoid using obvious passwords such as your date of birth or your pet’s name.

Beware of unsecured websites

- Check that the websites on which you carry out transactions are secure. Look for the padlock in the address bar and make sure the URL starts with“https://” rather than “http://”.

- Avoid suspicious or untrustworthy websites, especially those that ask for sensitive information such as bank details.

Keep an eye on your accounts

- Keep a close eye on your bank statements and online transactions.

- Report any suspicious activity to your bank immediately and ask them to take the necessary steps to protect your account.

Use an online protection solution

- Install reliable antivirus software and make sure it’s always up-to-date.

- Use a firewall to protect your computer against malicious intrusions.

Avoid sharing sensitive information in public

- Avoid sharing sensitive financial data, such as credit card details, in public places or on unsecured Wi-Fi networks.

Keep abreast of the latest fraud techniques

- Keep abreast of changing fraudulent practices, so you can take a proactive approach to protecting your financial information.

What's the solution to identity fraud?

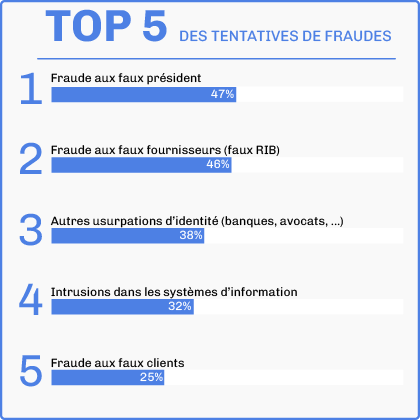

Identity fraud, which includes identity theft and president fraud, is extremely common. In fact, in the top 5, (fake) president fraud comes first (47%), closely followed by identity theft (38%). There are tools available to counter this scourge. Netheos, a specialist in identity verification since 2004, offers you 4 solutions to combat identity fraud, depending on your needs in terms of security and regulatory compliance.

By combining Artificial Intelligence with a team of human anti-fraud experts, Netheos has chosen the highest level of security for your customer onboarding KYC processes. Available 24/7 and based in Montpellier, France, our team is trained by fraud experts (customs officers, border police, national printing works) and is capable of analyzing a wide variety of documents (identity documents, supporting documents, certificates, etc.).

Solutions to combat document fraud

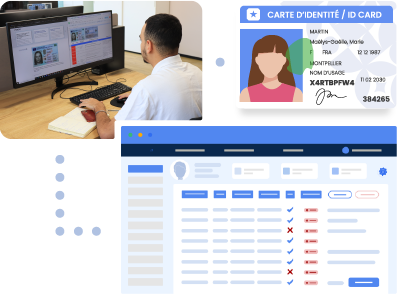

Document fraud practices include the counterfeiting and falsification of official documents (ID cards, passports, etc.), administrative documents (invoices, income statements, etc.) and diplomas and certifications. Easier to detect than the identification of individuals, manual verification is extremely time-consuming.

To overcome this problem, Netheos has created a solution that automatically checks documents and vouchers using proprietary Machine Learning algorithms and OCR technology.

In just 6 seconds, 4 layers of control are performed on the document:

- Quality: is the image acceptable: sharp, bright, well-framed?

- Type: is this the expected document?

- Consistency: is the information provided when the form is entered consistent with the data in the document?

- Authenticity: is it a counterfeit? Is the document forged?

The Netheos Doc Check solution can be used to check a wide range of documents, such as identity documents (ID cards, passports, residence permits, etc.), pay slips, tax notices, invoices, payment schedules and certificates.

Finally, to ensure the authenticity of digital documents that are increasingly easy to modify, and particularly since January 1, 2018 and the enactment of the VAT anti-fraud and software compliance laws, a set of technical and organizational processes has emerged: probative value archiving. This refers to the process of recording, storing and retrieving documents or digital data to prove their authenticity, integrity and intelligibility in the event of an audit.

- AML and LCB-FT: definition and missions

Fill in the form and we will contact you as soon as possible.

You can discover :

- How we can meet your specific needs and expectations

- A personalized demo, allowing you to appreciate the fluid experience we offer

- Customer feedback and case studies of similar companies that have integrated our solutions

- Advantages, benefits and value according to your use case